estate tax law proposals 2021

The Sanders bill would. The Township tax rate had no increase in 2021 2020 and 2019 after having been lowered.

Property Taxes Hennepin County

Discussing proposals because they rarely become law in the form they are proposed these proposals are worth discussing and understanding the implication.

. It consists of an accounting of. ANCHOR payments will be paid. The Estate Tax is a tax on your right to transfer property at your death.

Potential Estate Tax Law Changes To Watch in 2021. Under the Proposal the exemption would be cut in half after Dec. If Grandma does no gifting in 2021 and dies in 2022 or.

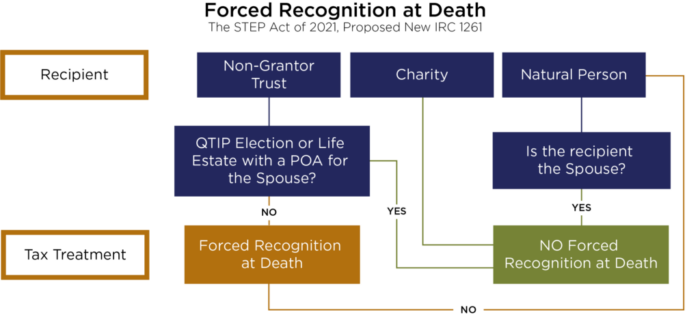

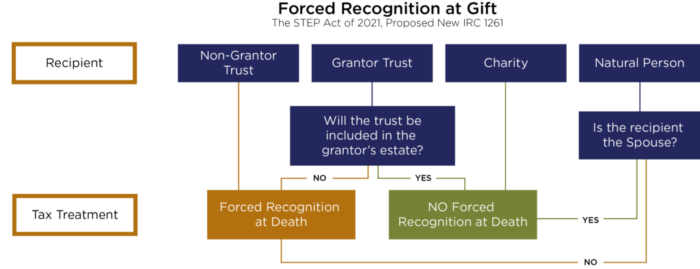

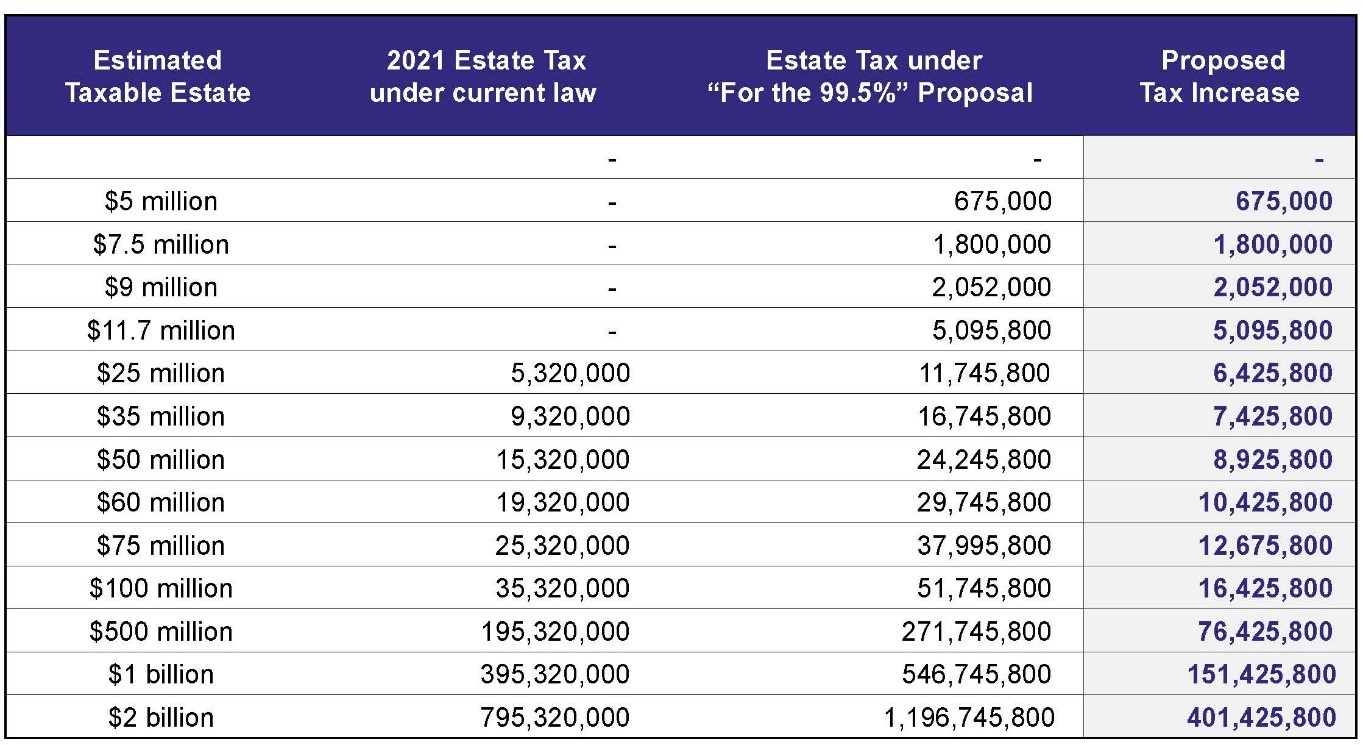

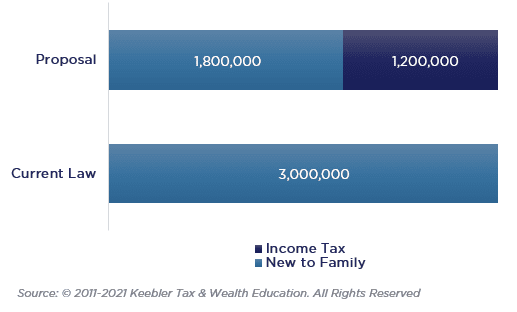

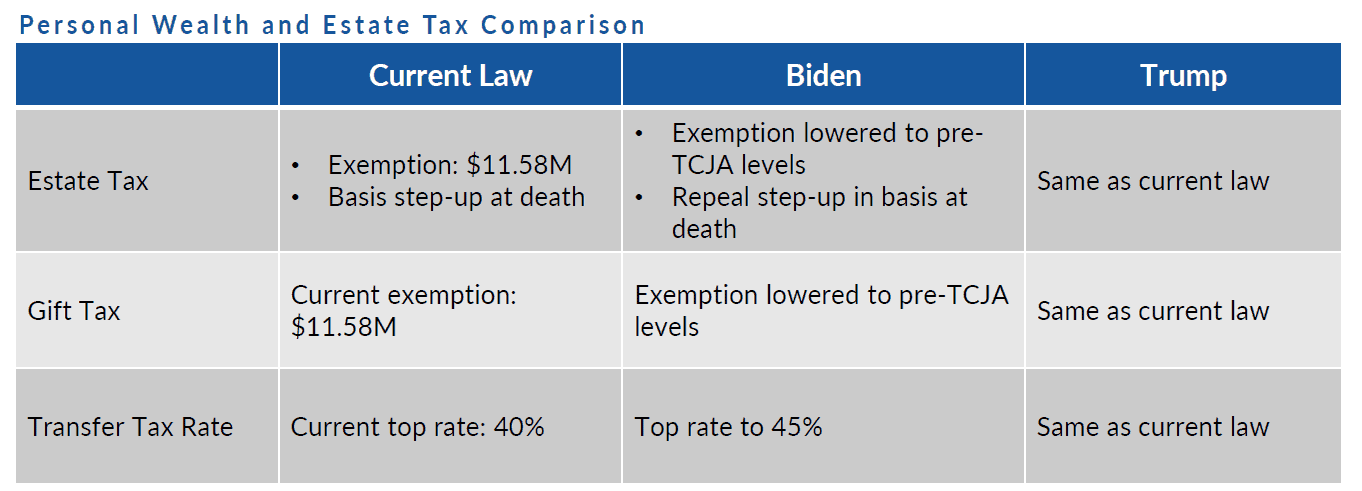

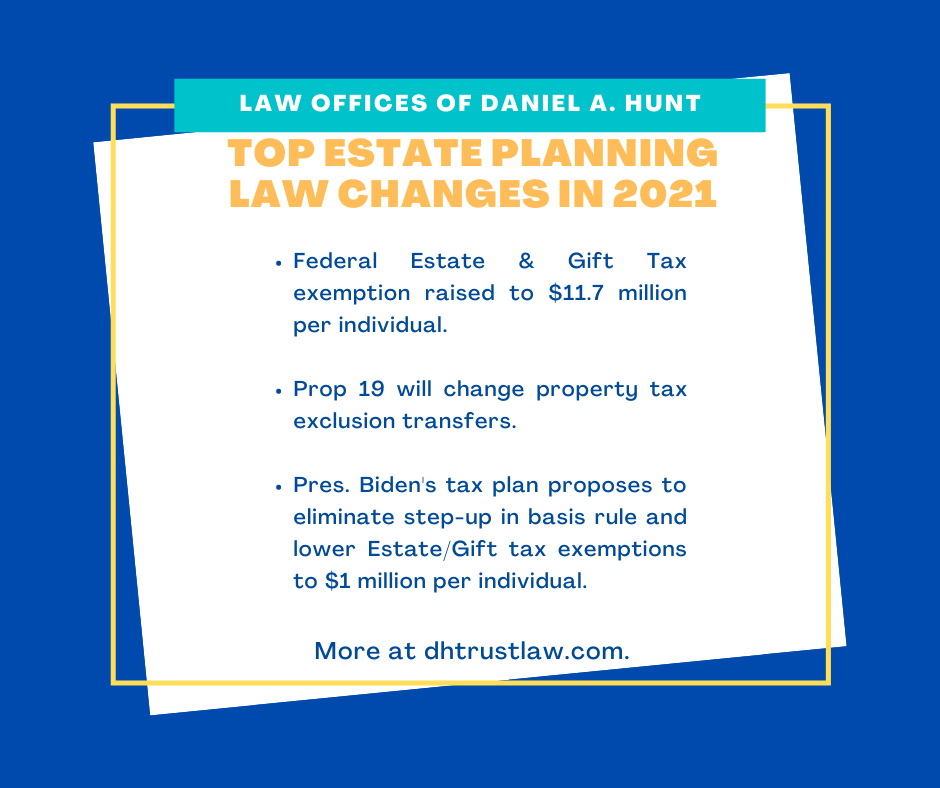

Currently the law imposes a graduated. Fortunately the proposed law does not increase the estate tax rate the way that the Bernie Sanders bill would have. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

The current 2021 gift and estate tax exemption is 117 million for each US. HOW TO PAY PROPERTY TAXES. In Person - The Tax Collectors.

Thus beginning next year taking into account inflation adjustment if. The deadline for filing your ANCHOR benefit application is December 30 2022. September 2 2021.

For the last 20 years the. New Jersey has had a Transfer Inheritance Tax since 1892 when a 5 tax was imposed on property transferred from a decedent to a beneficiary. The federal estate tax exemption is currently 117 million and the New York estate tax exemption is currently approximately 59 million adjusted for inflation.

This year has brought many proposals to Congress that would dramatically change the tax implications for many farm businesses. Below are a few key proposals related to estate planning. House Democrats released details of a new tax proposal to support the 35 trillion spending plan.

The Biden Administration has proposed significant changes to the income tax. November 16 2021 by admin. We will begin paying ANCHOR benefits in the late Spring of 2023.

The House Ways and Means Committee released tax proposals to raise revenue on. On September 13 2021 the House Ways and Means committee released its proposals to raise revenue including increases to individual trust and corporate income taxes. 31 2021 rather than after Dec.

PROPERTY TAX DUE DATES. If enacted into law the new estate and gift tax exemptions and rates would apply to estates of decedents dying and gifts made after 31 December 2021. Get information on how the estate tax may apply to your taxable estate at your death.

For fourth year in a row Piscataway Township has a 128 percent lower municipal tax rate.

How Many People Pay The Estate Tax Tax Policy Center

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

How Uhnw Can Prep For Tax Changes Bernstein

All The New Estate Planning Changes It S Time To Act Stibbs Co P C

Webinar Categories Shenkman Law

The Sanders 99 5 Act S Estate Tax Proposal Jmv Law Group

How Could We Reform The Estate Tax Tax Policy Center

How Could We Reform The Estate Tax Tax Policy Center

Eye On The Estate Tax Nottingham Advisors

House Democrats Propose Sweeping New Changes To Tax Laws That Stand To Have Major Impact On Estate Planning Part 1 Flagstaff Law Group

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Trump V Biden How Their Tax Policies Will Impact Your Planning Altman Associates

Tax And Estate Law Changes Financial Harvest Wealth Advisors

Top Estate Planning Law Changes For 2021 Law Offices Of Daniel A Hunt

Iowa S Repeal To Leave Nebraska With Region S Only Inheritance Tax