japan corporate tax rate history

Japan corporate tax rate history Saturday June 25 2022 Edit. Current Japan Corporate Tax Rate is 4740.

Malta Corporate Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical Chart

The Revenue Reconciliation Act of 1993 increased the maximum corporate tax rate to 35 for corporations with.

. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. Corporate tax rate in japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent. The total tax burden for corporations will vary between 2246 up to a steep 3681 March 2019 In Tokyo as effective rates depending upon factors like capital employees place of.

Measures the amount of taxes that Japanese businesses must pay as a share of corporate profits. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. Countries raise tax revenue through a mix of individual income taxes corporate income taxes social insurance taxes taxes on goods and services and.

Tax rates vary and depend on the amount of property or assets received. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an. Japan Corporate Tax Rate History.

Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an. Taxable Income Tax Rate less than 195 million yen 5 of taxable income 195 to 33 million yen 10 of taxable income minus 97500 yen 33 to 695 million yen. Principal business entities These are the joint stock company limited liability company partnership and branch of a foreign corporation.

S. National Income Tax Rates. 5 rows 73 51 73 53 Over JPY 8 million.

Japan corporate tax rate history Monday June 20 2022 Edit. Taxes imposed in Japan on income derived from corporate. The latest comprehensive information for - Japan Corporate Tax Rate - including latest news historical data table charts and more.

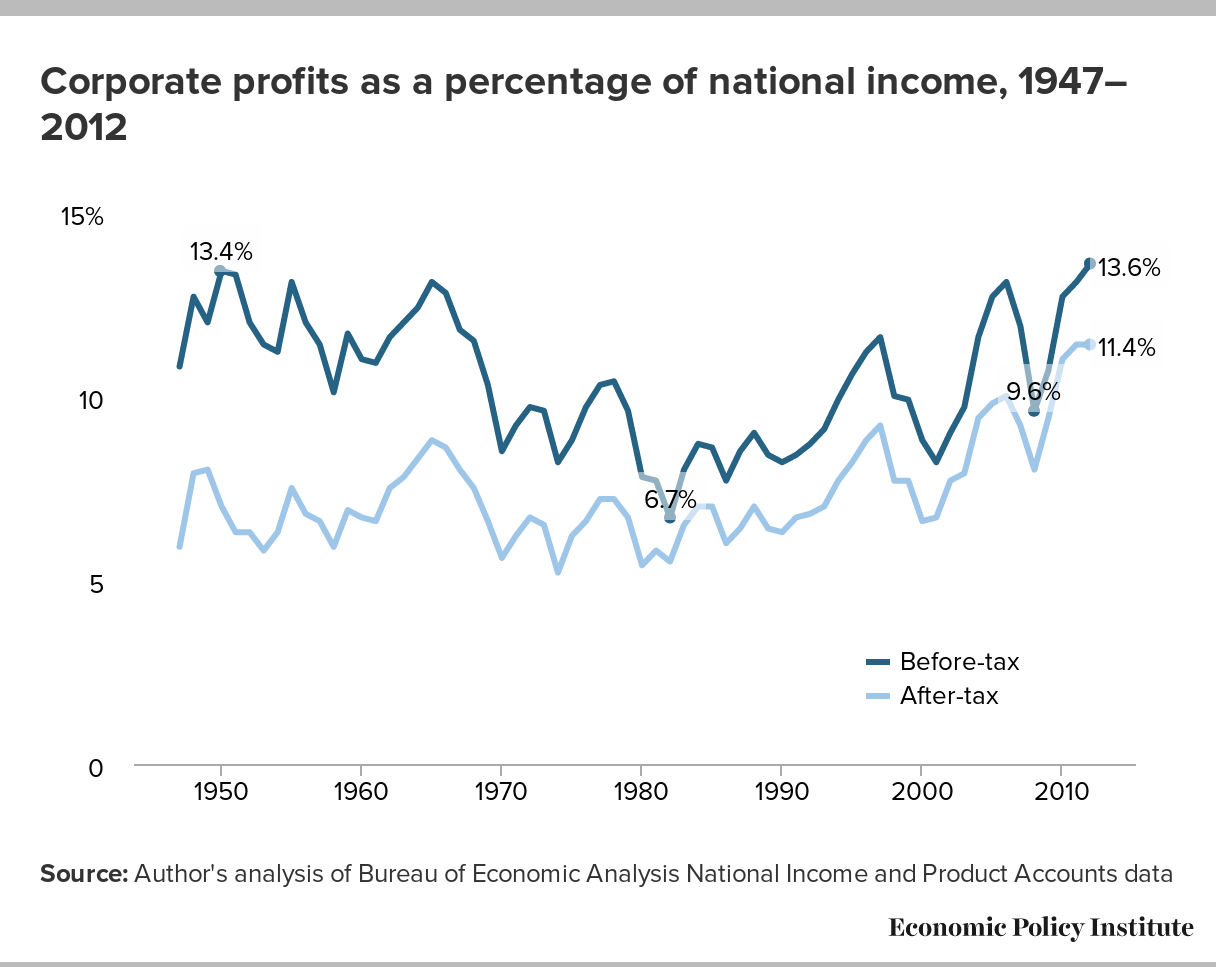

Japanese Inheritance Tax 2021. Japan Corporate Tax Rate table by year historic and current data. The trend in after-tax corporate profits as a percentage of national income.

Dec 2014 Japan Corporate tax rate. The latest comprehensive information for - Brunei Corporate Tax Rate - including latest news historical data table charts and more. 10 Year Treasury Rate.

Sources of Revenue in Japan. Tax Base Tax Rate. Taxable income over 10 million.

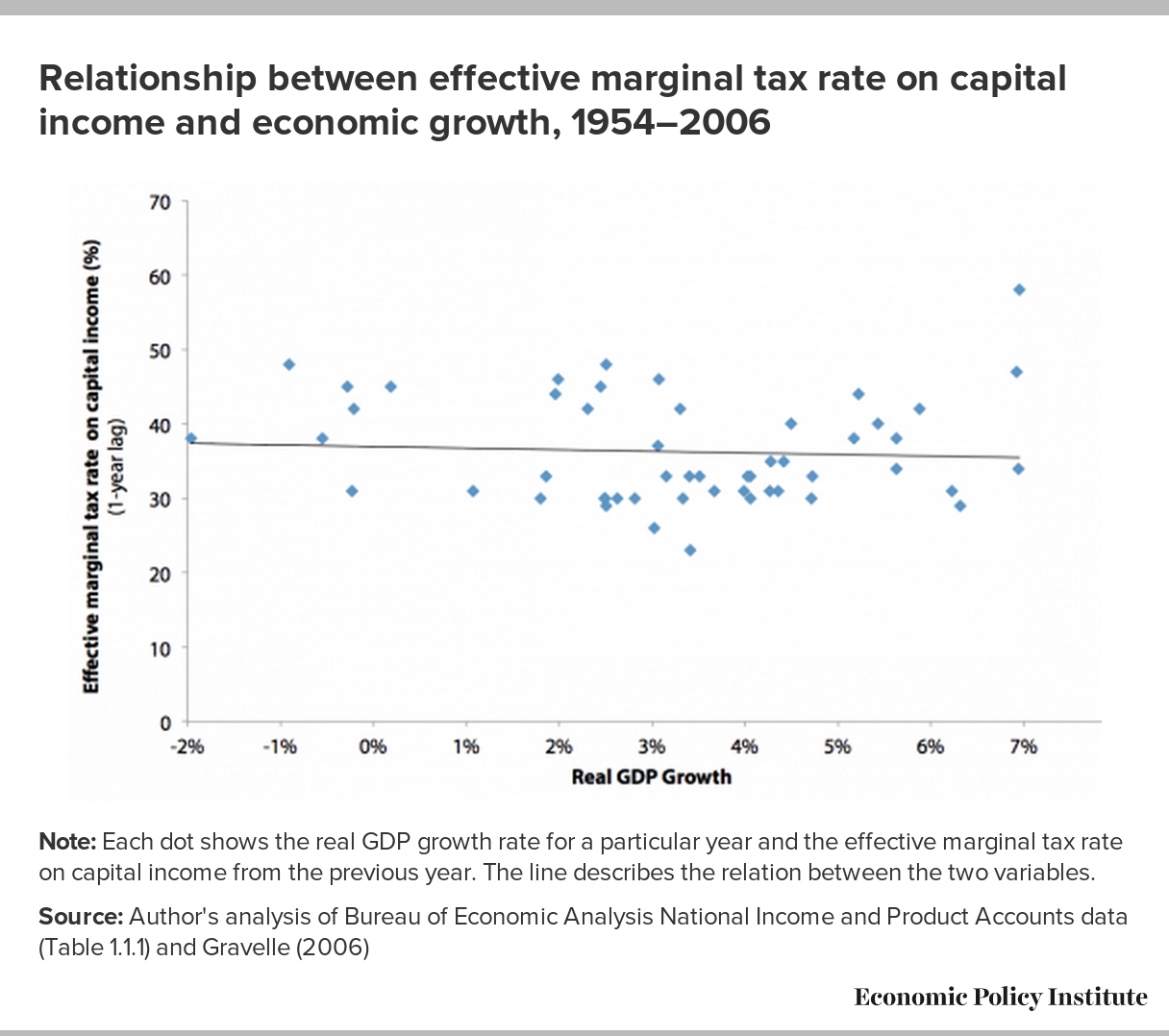

The paper is that the effective marginal tax rate on corporate capital income in Japan has increased sharply since 1980 from roughly 5 per-cent to about 32 percent. If the tax return is filed late a late filing penalty is imposed at 15 to 20 of the tax balance due. In the case that a corporation voluntarily files the tax return after the due date.

Toward Meaningful Tax Reform In Japan Cato Institute

Chile Tax Income Taxes In Chile Tax Foundation

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

Real Estate Related Taxes And Fees In Japan

Mexico Tax Rates Taxes In Mexico Tax Foundation

Real Estate Related Taxes And Fees In Japan

9 Things You Should Know About The Tax Debate Itep

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

Real Estate Related Taxes And Fees In Japan

Chile Tax Income Taxes In Chile Tax Foundation

Real Estate Related Taxes And Fees In Japan

Toward Meaningful Tax Reform In Japan Cato Institute

Corporate Tax Reform In The Wake Of The Pandemic Itep

Japan Tax Income Taxes In Japan Tax Foundation

Estonia Corporate Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical Chart